Risk Factors without LTCi Under the Age of 65

Considering the Risk

True or False: Long-Term Care Insurance is something that only older people should consider.

The answer is unequivocally False.

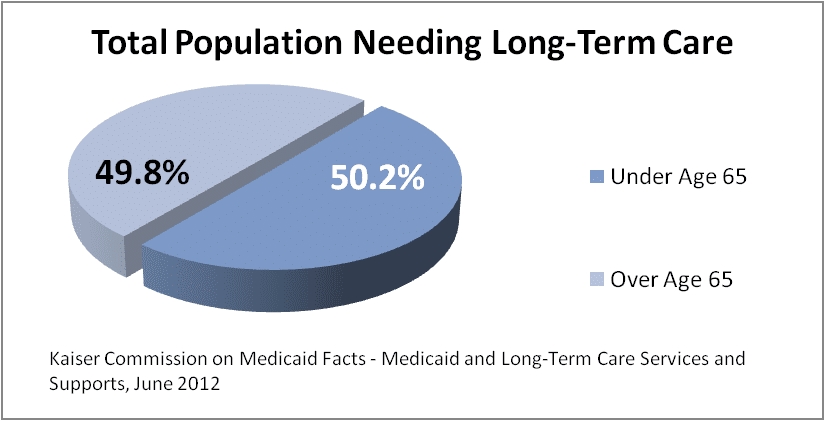

“Over 50% of people receiving care today are under the age 65.”

A frequent misconception is that long-term care insurance is only for the elderly or infirm. In reality, over 50% of people receiving care today are under age 65.

Why You Should Care When You’re Young

A frequent misperception is that long-term care insurance is only for the elderly or infirm. In reality, 50% of people receiving care today are under age 65.

It's not hard to imagine why such is the case:

- Automobile and Recreational Accidents (skiing, horseback riding etc.)

- Illnesses such as multiple sclerosis, stroke or heart attack

We all know of or can think of younger people who have had accidents which caused paralysis or someone who has a disease, such as Parkinson's.

Solution: Add to Your Risk Management Plan

With many working-age adults requiring long-term care services, it is easy to see that Long-Term Care Insurance is a product that everyone, regardless of age, needs to carefully consider as an addition to his or her risk management planning.

Long-term care services are only covered by Long-Term Care Insurance. It seems simple enough, but it's true - and it bears repeating...long-term care services are only covered by Long-Term Care Insurance.

Some people believe their Disability Income Insurance provides coverage if long-term care services are needed. However, Disability Income Insurance is normally designed to provide income so you can continue to meet your everyday bills and financial needs; it is usually not sufficient to pay also for long-term care services.

What Would You Do If Something Happened to You?

If you are not financially prepared for a long-term care need, your care options may be limited. Perhaps family members can help? Certainly family will want to help, but many family members today are either not geographically close enough to participate or are not in an economic position to assist financially. So, what do you do? Another option may be Medicaid.

Ready to find out more?

Let us help you set up an important piece to your risk management plan!